- The AI-powered solution is focused on simplicity without compromising compliance.

- Time for enrolment is cut down from days to minutes, thanks to fully automated ID check, electronic signature and real-time scoring.

(LUXEMBOURG / SENIGALLIA) – December 19, 2023 – Advanzia Bank, leading European digital bank specialising in credit cards and payment solutions, has simplified its consumer credit card onboarding process without compromising compliance. The integration of innovative digital trust services by leading pan-European provider Namirial Group not only streamlines the experience for credit card customers, but also enhances operational efficiency for the bank itself.

Austrian consumers are the first to benefit from an innovative process that allows them to sign up for the free Mastercard Gold in minutes instead of days. The new process was launched a few days ago. Initial feedback from consumers has been positive and re-confirms that fast, flawless service is quintessential for building relationships based on trust with new customers in the onboarding phase.

Advanzia Bank is addressing the increasing demand for speed, security and sustainability. Leveraging real-time scoring and real-time customer acceptance, Advanzia Bank has extended this capability to credit card applications, mitigating risk and enhancing operational efficiency while providing great convenience for its clients.

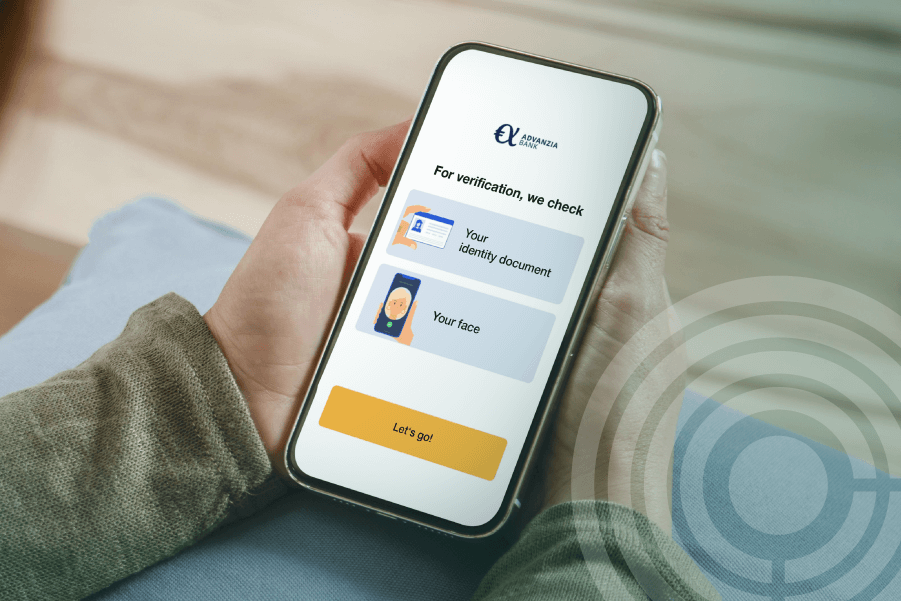

- The online application process, cut down from days to 10 minutes is setting a new industry benchmark. Advanzia Bank now offers an end-to-end digital customer journey, completing the credit card onboarding process in real-time. This, in turn, translates into a faster, seamless, and omni-channel experience for customers across all devices.

- The streamlined process, which does not require the customer to install anything on their devices, significantly reduces abandon rates, ensuring that more customers successfully complete their applications. It also allows to identify processes getting stuck and retrigger their execution by sending reminders or redirecting the process.

- The unified brand experience without the visibility of other service providers’ brands reinforces Advanzia Bank’s commitment to providing a fully digital experience for customers.

- The paperless onboarding process contributes to Advanzia’s commitment to sustainability – saving resources required for paper production.

Namirial facilitates a seamless process for new Advanzia customers by offering an automated user identity verification for provisioning of electronic certificates for the creation of qualified electronic signatures. By way of relying on this technology, Advanzia is able to fulfil its Know Your Customer (KYC) obligations as required under applicable law.

Advanzia and its customers benefit from a smooth, user friendly and cost-effective process. Using the Qualified Electronic Signatures for Know Your Customer, Advanzia can also address agreements requiring the written form in some jurisdictions. As defined in EU Regulation 910/2014 on electronic identification and trust services (eIDAS), wet-ink signatures can be replaced by Qualified Electronic Signatures with the same legal effects.

Since the late 90s, this type of electronic signature has had a reputation for being complicated to use and expensive, and this is still in the minds of many potential users. However, with Namirial’s solution, Advanzia makes using QES as easy as online banking: Thanks to remote electronic signatures, which are enabled EU-wide through the eIDAS-Regulation, the vast majority of QES are created as remote electronic signatures, with certificates stored in the secure processing centre of accredited trust service providers, rather than on smart cards. Advanzia also plans to use remote e-signing for the launch of its end-to-end digital credit card application in Germany in 2024.

With Namirial, Advanzia enables its customers to provide their signature in a fully automated process, using qualified electronic signatures without requesting any registration with a trust service provider. Moreover, Advanzia benefits of single sourcing for its digital trust services: As the Namirial Group consists of multiple Qualified Trust Service Providers based in different countries, e. g. Namirial in Italy and Uanataca in Spain, Advanzia can use a combination of digital trust services of both Qualified Trust Service Providers for proof of compliant Know Your Customer processes. Having another independent Qualified Trust Service Provider verifying a Qualified Electronic Signature adds another layer of trust to the KYC process, fulfilling the highest security requirements.

The world of banking grapples with multifaceted hurdles that demand rigorous attention and strategic finesse. At the forefront of these challenges is the intricate web of regulatory compliance. The labyrinthine nature of these regulations, which often vary from one jurisdiction to another, necessitates extensive resources and expertise to ensure full compliance.

As of today, Advanzia has integrated Namirial Digital Trust Services for user identity verification, certificate provisioning for qualified electronic signature creation, signature validation and long-term archiving. The orchestration of the signature workflow is provided by Namirial as well, seamlessly integrated into Advanzia processes without any Namirial branding.

Nishant Fafalia, CEO of Advanzia said: “Thanks to Namirial Digital Trust Services, we not only provide our customers with a faster and more convenient experience, but we also contribute to a more sustainable and paperless future. Our commitment to innovation drives us to continuously redefine our digital services, making banking better for our customers and more efficient for our organisation. We appreciate Namirial’s capabilities to source both automated identity verification with modern machine learning based AI technology and trust services for qualified e-signature (QES) from one single provider in a one-stop-shop setting.”

Max Pellegrini, CEO of Namirial said: “We are happy to welcome Advanzia in our customer ecosystem as we share the same innovative spirit and dedication for relationships built on trust. Namirial has been focused on delivering best in class Digital Trust Services for regulated industries for many years, supporting our customers to do business across the globe. We are looking forward to a great inspiring partnership which will become one of the major success chapters our company’s history.”

About Advanzia

Founded in 2005 in Luxembourg, Advanzia Bank S.A. is a European digital bank specialising in credit cards and payment solutions. With more than 2.2 million credit card customers, Advanzia is a leading credit card issuer in Germany and has a strong presence in Luxembourg, France, Austria, Spain, and Italy. As well as issuing consumer credit cards under its own brands, Advanzia is a leading provider of Cards-as-a-Service solutions for more than 270 companies, associations, and financial institutions. Business partners use Advanzia’s co-branded credit cards to strengthen customer loyalty and create a competitive advantage. Private banks implement turnkey Visa and Mastercard credit card programmes delivered by Advanzia, either as white label cards or under the flagship brand Capitol. In 2022, Advanzia achieved a total credit card turnover of EUR 5.3 billion for all its market segments. At the end of 2022, the bank employed 196 employees.

To learn more, visit advanzia.com, follow Advanzia on LinkedIn or contact the Communications department:

Media contact

Sara Nobels

Head of Communication & PR

Sara.Nobels@advanzia.com

About Namirial

Namirial supports customers in their digital transformation journey by providing solutions for trusted digital transaction management. Namirial digital trust services encompass solutions for customer onboarding, agreement automation, signature workflow orchestration, identification, multi-factor authentication, electronic signature, electronic registered delivery, long-term archive and electronic invoice.

Founded in 2000 in Senigallia, Italy, Namirial Group is operating today in over 85 countries, employing over 900 people. Together with its international network of over 150 strategic partners, the Namirial Group is serving over three million customers worldwide, processing several millions of transactions every day. Namirial Group includes Namirial, Netheos (acquired in 2021), Evicertia, Bit4ID Group, Uanataca, Agenzia Trotta (all acquired in 2022) and Unimatica (acquired in 2023). Namirial, Evicertia and Uanataca are accredited as qualified trust service providers under EU Regulation 910/2014 eIDAS.

To learn more, visit namirial.com, follow Namirial on X (formerly Twitter), LinkedIn and Facebook or contact Namirial.

Media contact

Jörg Lenz, Head of MarCom Namirial

j.lenz@namirial.com